In early March, downstream demand continued to recover, driving improved seamless pipe market transactions, albeit dominated by low-price deals. Traders prioritized inventory clearance, while mills maintained strong pricing resilience, partially reclaiming profits. By mid-to-late March, mill output expanded further, inventories declined faster than expected, and market sentiment remained cautiously optimistic. Looking ahead to April, this report analyzes March fundamentals and provides a forecast.

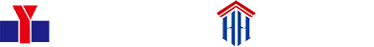

Average Price: The national seamless pipe (20#, 108*4.5mm) price fell to RMB 4,387/ton by March 31, down RMB 46/ton (-1.04%) from February 28, due to weaker cost support.

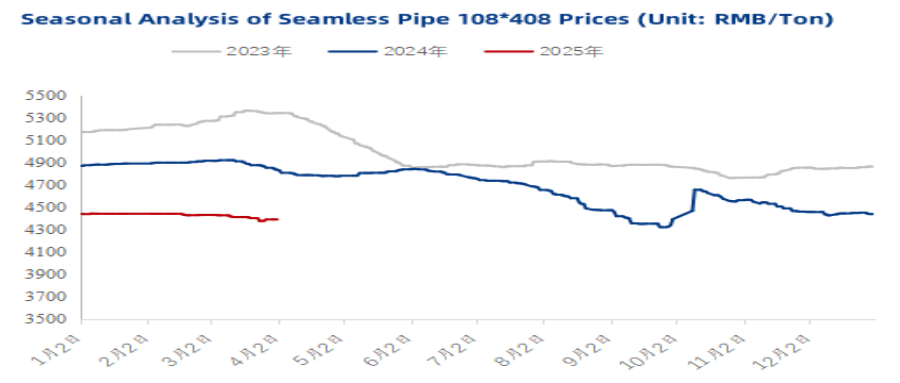

Shandong Mills: Theoretical losses narrowed to -RMB 20/ton (vs. -RMB 30/ton in February), as raw material costs eased.

Pipe Billet Prices: Shandong pipe billets dropped to RMB 3,470/ton (-0.86% MoM), though mills resisted deeper cuts amid balanced supply-demand.

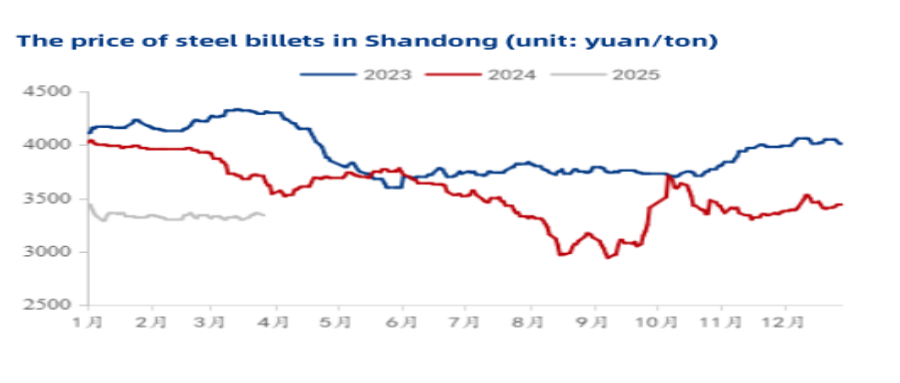

Production: March output reached 357,100 tons (+1.97% MoM), with capacity utilization at 77.60% (+4.57% MoM).

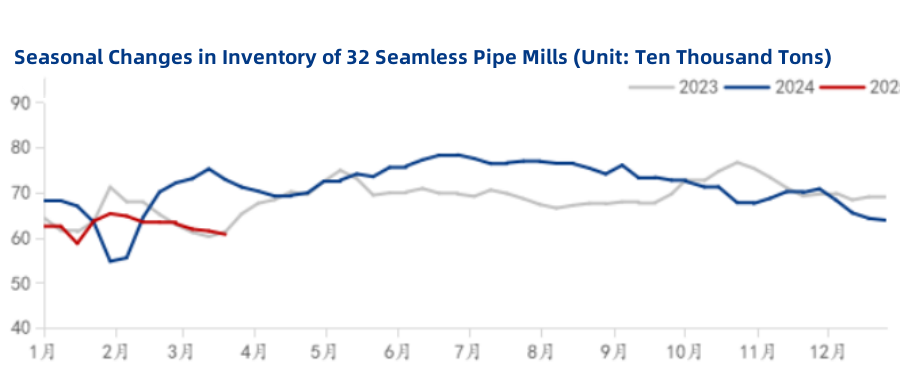

Mill Inventories: Fell to 607,400 tons (-2.67% MoM) as demand absorbed increased output.

April Outlook: Some mills plan maintenance, likely curbing output growth.

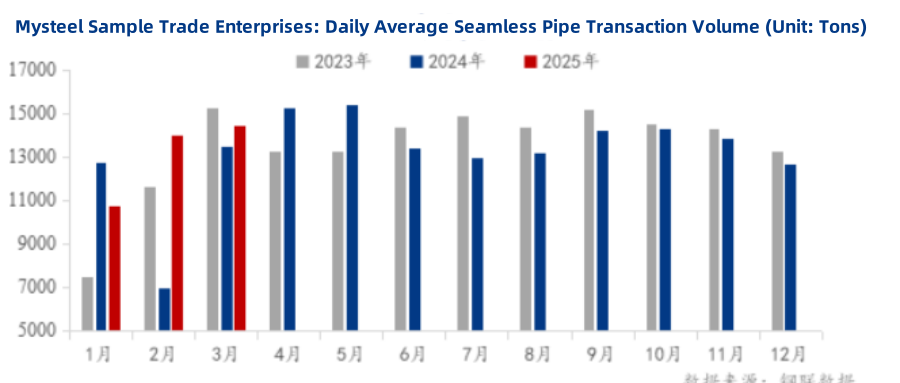

Transactions: Weekly trade volume rose to 15,760 tons (+1,427 tons WoW) in late March, with daily average sales up 9.37% YoY.

Market Sentiment: Improved but fragile, with traders wary of sustained demand momentum.

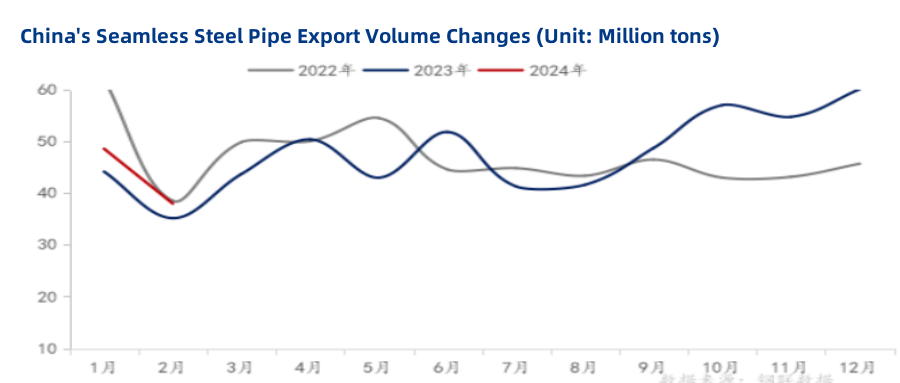

Jan-Feb 2025 Exports: 572,260 tons (+9.12% YoY), driven by pre-tariff "panic orders." February exports fell to 37,990 tons (-21.85% MoM) but remained above 2024 levels.

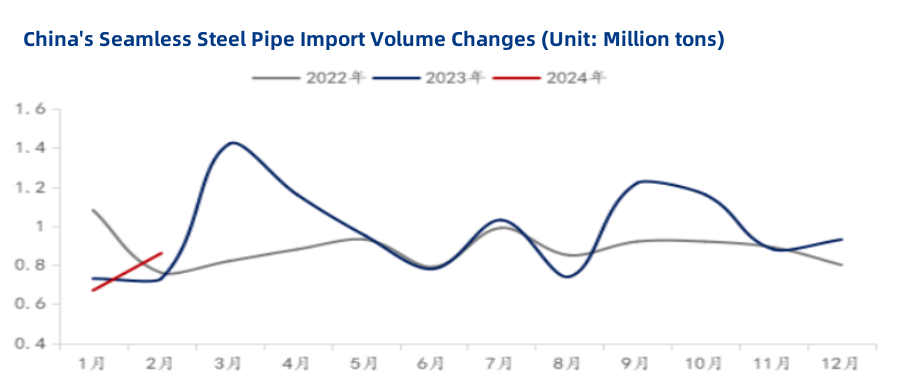

Imports: 15,300 tons (+4.79% YoY), resulting in a net export of 371,300 tons (+7.78% YoY).

Risk Note: Rising global trade friction threatens export stability.

Macro Factors: Policy support remains muted, but industrial profit recovery and debt resolution may stabilize sentiment.

Cost Pressures: Iron output could rise further, while coal/coke prices may rebound, lifting costs.

Supply-Demand Balance: Output likely peaks, while demand continues gradual recovery.

Price Forecast: Seamless pipe prices are expected to fluctuate with upward bias in April, though gains will be limited by weak trader confidence and funding constraints.