Overview: This week, the black commodities futures market experienced fluctuations and adjustments, with a pronounced sense of market caution. On the international front, the Eurozone's manufacturing PMI for October remains weak, the IMF has downgraded global economic forecasts for next year, and the upcoming U.S. elections may further influence market sentiment. Domestically, several banks will begin adjusting existing personal mortgage rates in bulk starting October 25. In northern regions, heavy pollution weather alerts have been issued, affecting production in some pipe manufacturing plants. Market-wise, the output of seamless pipe manufacturers has slightly decreased, while the production enthusiasm of shaping and rolling enterprises is generally moderate, leading to difficulties in order-taking for pipe manufacturers. Raw material prices are fluctuating weakly, with instant profits for seamless pipe manufacturers in Shandong significantly contracting, and production in northern pipe manufacturers potentially declining further due to environmental restrictions. As of October 25, prices of seamless pipes have fallen in most major cities.

Seamless Pipe Prices: According to Mysteel's data, as of October 25, the average price of 108*4.5mm seamless pipes in 28 major cities across the country is 4,554 RMB/ton, a week-on-week decrease of 42 RMB/ton, with most mainstream market prices showing a weak trend this week.

Raw Materials: As of this Friday, raw material prices have continued to decline significantly, with the rate of decrease narrowing compared to last week. Shandong's pipe billet prices dropped by 70 RMB/ton week-on-week, while Jiangsu's pipe billet prices remained stable, leading to an expanded price gap between Jiangsu and Shandong.

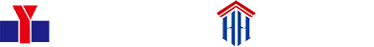

In terms of seamless pipe profits, the high billet prices have led to a significant reduction in profits for pipe manufacturers, as the price adjustments for finished products have not kept pace with costs. Taking the example of 20# hot-rolled Ф108*4.5mm seamless pipes, the profit for seamless pipe manufacturers in Shandong is -30 RMB/ton, a week-on-week decrease of 450 RMB/ton. In Jiangsu, the profit for sample enterprises producing seamless pipes is 160 RMB/ton, down 440 RMB/ton from the previous week. The profit margins for shaping and rolling enterprises are also under pressure, leading to slower production. Costs may undergo further adjustments, and it is expected that profits for seamless pipe manufacturers may recover somewhat next week.

This week, the prices of hot-rolled pipe billets in Shandong and Jiangsu fell by 70 and 30 RMB/ton week-on-week, respectively. Some mainstream seamless pipe manufacturers in Shandong adjusted their factory prices by 20-150 RMB/ton, with mixed increases and decreases. In East China, the prices of seamless pipes in several major markets decreased by 50-80 RMB/ton week-on-week, with the Shanghai market seeing a decrease of 50 RMB to 4,590 RMB/ton. The prices in Nanjing and Hangzhou markets fell by 80 and 70 RMB, respectively, to 4,360 and 4,540 RMB/ton, showing a larger adjustment compared to last week.

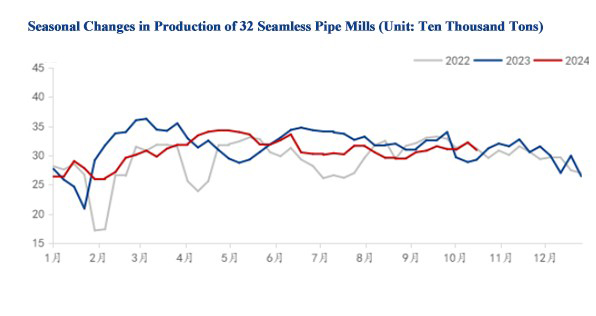

In terms of pipe manufacturers, the production at sample plants slightly decreased this week, while inventory levels increased, along with a minor rise in social inventory. Despite a noticeable decline in raw material prices this week, market price adjustments have been slow, and overall willingness among merchants to replenish stocks remains weak, with a lingering fear of further price drops. In the context of significant price fluctuations, market transactions have been sluggish, and merchants are cautiously pessimistic about the market outlook for October. Overall, it is expected that seamless pipe prices in the East China region may trend weakly and stabilize in the short term.

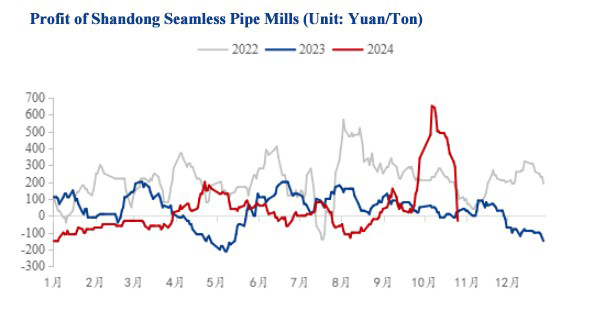

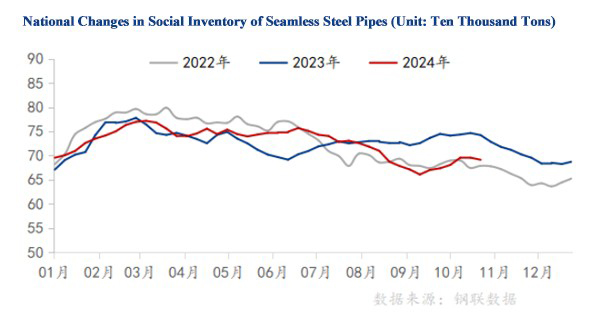

According to Mysteel's survey of nationwide seamless pipe inventories (123 enterprises), the social inventory of seamless pipes stands at 691,200 tons this week, a week-on-week decrease of 0.44%. From Mysteel's survey of seamless pipe production enterprises (33 companies), the internal inventory is 712,700 tons, showing a week-on-week increase of 0.03 tons, but a year-on-year decrease of 21,000 tons. The raw material inventory is 284,600 tons, with a week-on-week increase of 3,300 tons and a year-on-year increase of 5,500 tons. As we move into mid to late October, downstream demand has been released slowly, leading traders to actively reduce inventory levels. Consequently, pipe manufacturers are facing increased order pressure, with further accumulation risks in factory inventory.

From a price perspective: This week, mainstream seamless pipe prices fluctuated, with traders continuing to lower their quotes, focusing primarily on sales, while costs underwent adjustments.

From a fundamental standpoint: Many northern regions have issued weather pollution alerts, impacting production in some Shandong pipe manufacturers, potentially leading to a decrease in output. Market sales remain poor, and the north is approaching a demand off-season, with limited future demand increases.

From a sentiment perspective: Despite several favorable macroeconomic signals, downstream customers are still facing relatively tight funding situations, leading to cautious merchant attitudes.

Over all, while short-term macro expectations may support black commodity spot prices, slow demand release and general demand conditions, along with production restrictions at northern pipe manufacturers, are expected to ease supply pressure. It is anticipated that seamless pipe prices nationwide will continue to consolidate next week.