This week, futures steel prices trended weak, with average market transactions.

Global Context:

U.S. December ADP employment report showed an increase of 122,000 jobs, below the forecast of 140,000, marking the lowest level since August.

The U.S. dollar index remained high.

Domestic Context:

In December 2024, China's CPI rose 0.1% YoY and remained flat MoM.

The Caixin Services PMI rose to 52.2, beating expectations.

The Ministry of Finance announced an extension of the equipment upgrading loan interest subsidy policy, potentially signaling strengthened monetary policy expectations.

Pipe Mills:

Market demand continued to decline, leading to insufficient orders at major pipe mills. Supply levels remained low. As of Jan 10, seamless pipe prices in most cities were stable, with minor adjustments in some areas.

Seamless Pipe Prices

Mysteel data shows that as of Jan 10, the national average price for seamless pipes (108*4.5mm) was RMB 4,444/ton, up RMB 3/ton WoW. Most markets remained stable, with minor adjustments in some areas.

Raw Material Prices

Shandong billet prices fell RMB 130/ton WoW.

Jiangsu billet prices fell RMB 10/ton WoW.

The price gap between Jiangsu and Shandong billets widened significantly.

Mill Price Adjustments

According to Mysteel's survey of 34 sample seamless pipe mills, most maintained stable prices this week, while a few adjusted prices by RMB 20–50/ton.

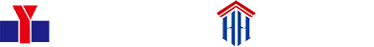

Jiangsu mills saw slight improvement in profitability this week:

Shandong sample mills reported a profit margin of -RMB 40/ton, flat WoW.

Jiangsu sample mills reported a profit margin of RMB 110/ton, up RMB 20/ton WoW.

The softening of upstream raw material prices provided some relief to mill profits.

Shandong billet prices fell RMB 100–140/ton WoW.

Seamless pipe ex-factory prices from major Shandong mills showed mixed trends.

Prices in East China markets:

Shanghai prices rose RMB 20/ton WoW.

Nanjing and Hangzhou prices remained flat.

As the year-end approaches, demand is expected to decline further. Traders’ winter stockpiling enthusiasm remains low, and the market is characterized by nominal prices without active transactions.

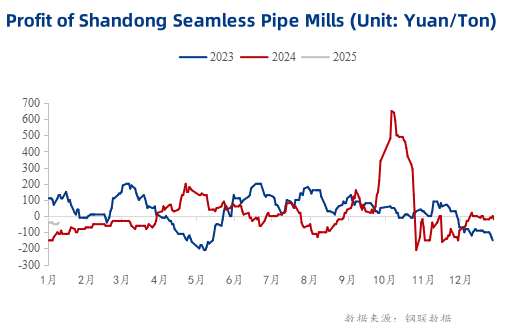

National Inventory

The total seamless pipe social inventory reached 661,400 tons, up 1,900 tons WoW.

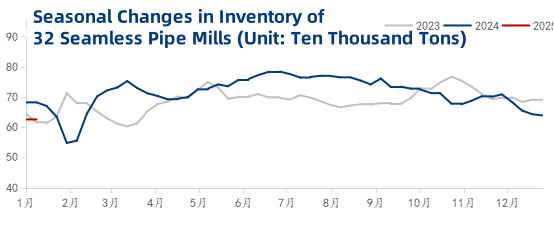

Mill Inventory

Factory inventory: 625,500 tons, down 13,200 tons WoW and 57,800 tons YoY.

Raw material inventory: 271,900 tons, down 200 tons WoW and 7,000 tons YoY.

Decreasing orders prompted mills to actively reduce inventory, leading to a slight decline in factory stocks.

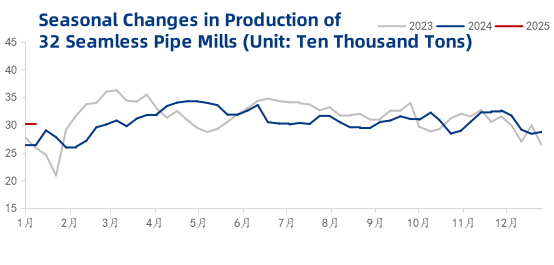

Weekly production: 301,600 tons, up 14,200 tons WoW but down 15,300 tons YoY.

Capacity utilization rate: 65.54%, up 3.09% WoW but down 3.32% YoY.

Operating rate: 45.08%, up 4.1% WoW but down 5.74% YoY.

With declining demand and weak winter stockpiling enthusiasm, mills continued to operate at relatively low levels. Short-term production levels are expected to remain low.

Prices

This week, raw material prices trended weaker, falling RMB 10–130/ton WoW. Seamless pipe prices were largely stable, with minimal fluctuations ahead of the holiday season.

Fundamentals

Supply slightly increased this week, but demand remains weak. The seamless pipe market is characterized by low supply and demand.

Sentiment

Market sentiment remains cautious as futures prices fluctuate, and downstream purchasing enthusiasm is limited.

Conclusion

The seamless pipe market has entered the seasonal demand off-season. With declining supply and stagnant demand, the market remains cautious. National seamless pipe prices are expected to slightly decline with volatility next week.