Overview

This week, steel futures fluctuated at low levels, while raw materials showed relative strength. Market activity remained subdued, with traders adopting a cautious stance. Globally, the U.S. President signed executive orders imposing a 10% "baseline tariff" on certain trade partners and higher rates for others. U.S. March ADP employment rose by 155,000 (vs. 115,000 expected). Domestically, China’s March Caixin Manufacturing PMI hit 51.2, a four-month high. Seamless pipe prices edged down RMB 6/ton WoW amid balanced supply-demand growth.

Seamless Pipes: The national average price for 108*4.5mm pipes fell to RMB 4,387/ton by April 3 (-RMB 6/ton WoW), with regional declines.

Raw Materials: Shandong pipe billets held steady, while Jiangsu prices dropped RMB 10/ton. The Jiangsu-Shandong price gap narrowed by RMB 10/ton.

Mill Adjustments: 34 surveyed mills kept prices mostly stable, with select adjustments of RMB 50–80/ton.

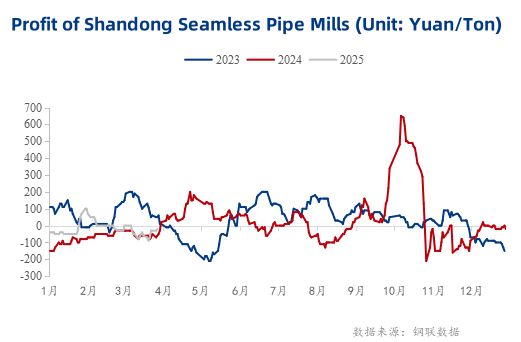

Shandong Mills: Losses widened to -RMB 40/ton (-RMB 10/ton WoW).

Jiangsu Mills: Profits rose to RMB 240/ton (+RMB 40/ton WoW) as raw material costs eased.

Shandong pipe billet prices fluctuated (+/- RMB 10–30/ton WoW), while seamless pipe ex-factory prices weakened. Regional output rose, inventories dipped, and traders prioritized stable pricing. Weak demand may drive further declines.

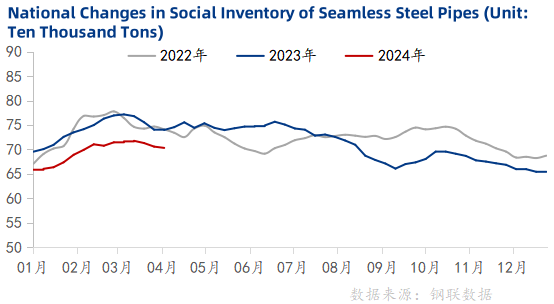

Social Stocks: Fell 2,600 tons WoW to 703,200 tons.

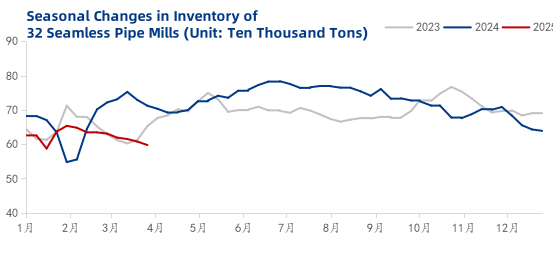

Mill Stocks: Dropped 10,100 tons WoW to 597,300 tons (-3.35% MoM).

Production: Output rose 9,400 tons WoW to 366,500 tons (+2.56% MoM), with capacity utilization at 79.64%.

Price Outlook: Raw material resilience and mill price support may stabilize prices, but weak demand limits upside.

Fundamentals: Rising output clashes with slow consumption, keeping traders focused on destocking.

Sentiment: Caution prevails amid U.S. tariff risks and domestic policy uncertainties.

Conclusion: Seamless pipe prices are expected to consolidate next week, with limited volatility driven by cost support and muted demand.