Overview

Steel futures rebounded this week as markets digested macro developments. Globally, the U.S. paused tariffs on select nations (Nasdaq +12%), while China hiked tariffs on U.S. goods to 125%. U.S. March ADP employment rose by 155,000 (vs. 115,000 expected). Domestically, the central bank injected RMB 28.5 billion via a 7-day reverse repo at 1.50%. Seamless pipe prices fell RMB 29/ton WoW amid mixed demand recovery.

Seamless Pipes: National average price for 108*4.5mm pipes dropped to RMB 4,358/ton (-29/ton WoW), with widespread regional declines.

Raw Materials: Shandong pipe billets fell RMB 40/ton WoW, while Jiangsu prices dipped RMB 20/ton, widening the regional gap.

Mill Adjustments: 34 surveyed mills cut prices by RMB 20–50/ton.

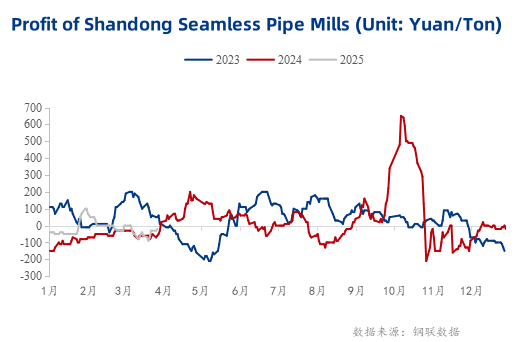

Shandong Mills: Losses held at -RMB 40/ton (flat WoW).

Jiangsu Mills: Profits rose to RMB 290/ton (+50/ton WoW) as costs eased.

Shandong pipe billet prices fluctuated (-30–40/ton WoW), with mills prioritizing discounts. Weak demand may prolong price declines.

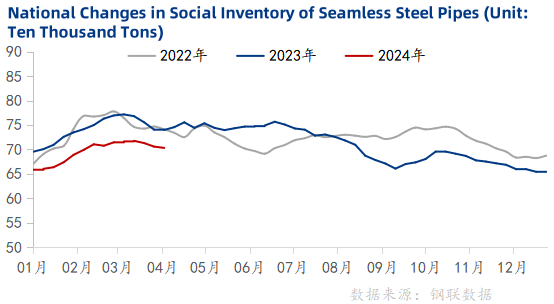

Social Stocks: Fell 2,300 tons WoW to 700,900 tons.

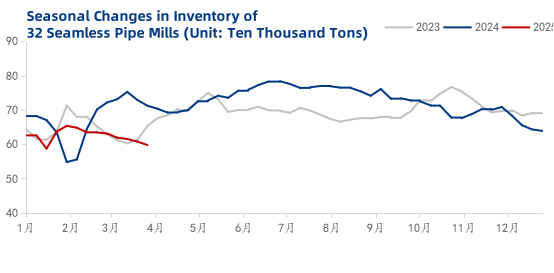

Mill Stocks: Rose 5,200 tons WoW to 602,500 tons, signaling weaker orders.

Production: Output edged up to 368,300 tons (+1,800 tons WoW), with capacity utilization at 80.03%.

Price Outlook: Cost-driven declines persist, but futures strength may limit downside.

Fundamentals: Rising mill inventories clash with sluggish demand, pressuring traders to prioritize destocking.

Sentiment: Cautious restocking dominates amid tariff uncertainties and competitive pricing.

Conclusion: Seamless pipe prices are expected to stabilize with a weak bias next week, supported by limited demand recovery and soft cost trends.