Overview

In Q1 2025, China’s seamless pipe market faced supply-demand imbalances, with seasonal consumption lagging behind historical levels. Prices trended downward, and cautious producers prioritized volume over margins. Despite April being a traditional peak season, demand recovery remains sluggish. This report analyzes price, inventory, and supply-demand dynamics to forecast near-term trends.

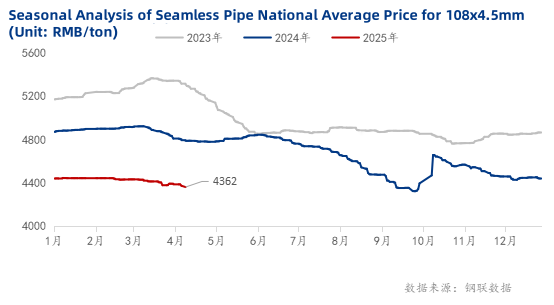

Current Prices: As of April 8, 2025, the national average price for 108*4.5mm seamless pipes fell to RMB 4,362/ton (-25/ton WoW, -427/ton YoY).

Q1 Performance: Prices hit a three-year low, with the "Golden March" failing to reverse declines. April prices are expected to remain weak.

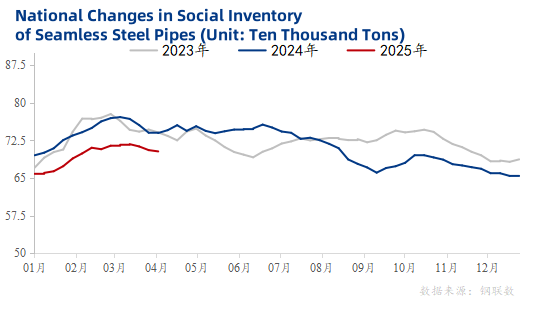

Social Inventory: Dropped to 703,200 tons (-2,600 tons WoW, -13,300 tons MoM), signaling tentative demand recovery from infrastructure projects.

Trader Sentiment: Post-holiday restocking remains muted, with dealers aggressively destocking amid weak orders. Slow inventory drawdowns are expected to persist.

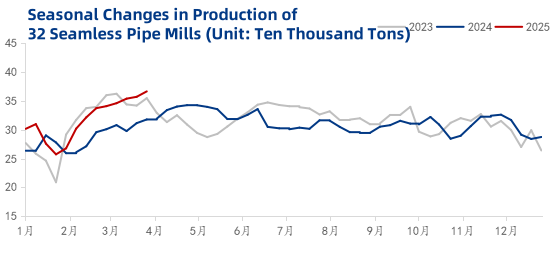

Production: Output rose to 366,500 tons (+2.6% WoW, +7.5% MoM), with capacity utilization nearing 80%. Mills maintain stable operations despite inventory pressures.

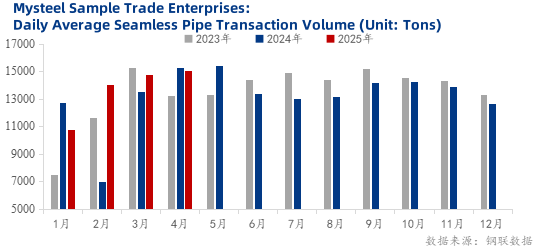

Transactions: Weekly volume fell to 15,073 tons (-4.4% WoW), with April daily sales down 4.4% YoY. Seasonal delays and buyer caution dampen momentum.

Key Drivers:

Infrastructure: Accelerated special bond issuance may boost demand in Northwest/Central China.

Real Estate & Manufacturing: “Project delivery” efforts and restocking cycles are critical for East/South China recovery.

Supply Glut: High mill inventories (+MoM) clash with weak demand, forcing price cuts and margin erosion.

Demand Risks: Sustained policy stimulus is needed to avoid inventory re-accumulation.

Policy Surprises: Aggressive infrastructure spending could disrupt supply-demand balance.

Geopolitical Costs: Escalating conflicts may raise raw material prices, squeezing margins.

Production Discipline: Insufficient industry-wide output cuts may deepen price declines.

Conclusion: The seamless pipe market will likely remain under pressure in April, with prices oscillating weakly unless demand recovers sharply.