Since March, black commodity futures have declined sharply. Rebar futures closed at RMB 3,088/ton on April 9 (-164/ton MoM), while hot-rolled coil fell to RMB 3,208/ton (-241/ton MoM). In contrast, seamless pipe spot prices dropped RMB 50–100/ton post-mid-March, with limited downward depth. What drives this trend? Let’s analyze fundamentals.

Production: Weekly output reached 366,500 tons (+25,600 tons YoY) in early April, with capacity utilization exceeding 70% despite a 50% operating rate.

Inventory: Mill stocks rose to 366,500 tons (+13,800 tons MoM), while social inventories fell to 703,200 tons (-739,900 tons YoY).

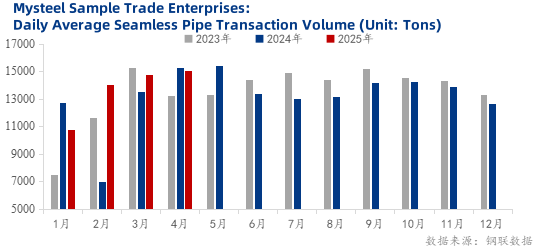

Transactions: Daily sales declined slightly in early April but remained above 2024 levels. Southwest and Northwest China outperformed due to infrastructure projects, while East/North China lagged.

Drivers: Increased mill direct sales and untapped demand potential in key regions offset weaker trader activity.

Iron Ore & Coke: Iron ore futures (Sept: RMB 689/ton; Jan: RMB 669/ton) and coke (Sept: RMB 1,567/ton; Jan: RMB 1,630/ton) show mixed near-term trends.

Cost Reductions: Blast furnace costs fell RMB 100/ton MoM to RMB 2,439/ton, while pipe billet prices dropped RMB 60/ton.

Tight Balance: Supply-demand remains stable, with limited linkage to black futures.

Cost Uncertainty: Divergent iron ore and coke price trajectories amplify margin risks.

Tariff Lag: U.S./EU trade policies may impact exports later in 2025.

Conclusion: Short-term price volatility will hinge on cost fluctuations, with mill margins under pressure. Monitor output adjustments and policy shifts.